excise tax ma pay

Available payment options vary among services and our online payment partners. Mayor Yvonne Spicer closed the Memorial Building to the public this week so bills must be mailed or paid online and can not be paid in person.

City Of Lowell Ma Government Motor Vehicle Excise Tax Bills For The 2021 Tax Year Have Been Mailed And Are Due On 3 25 2021 Please Call The Collector S Office If You

Motor Vehicle Excise Information Motor Vehicle Excise FAQs.

.jpg)

. Motor Vehicle Excise Tax Bills are online by the time you receive your printed copy of the bill in the mail and are online while they are available for payment using Invoice Cloud. Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Bills that are more than 45 days past due are marked at the registry for.

Box 1492 Lanesborough MA 01237. First notices and demand notices are available for payment on the Invoice Cloud system. If you are unable to find your bill try searching by bill type.

Reserve a parking spot for your moving truck. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of Revenue will bill. Learn about excise tax and how Avalara can help you manage it across multiple states.

Payment is due 30 days from the date the excise bill is mailed. Pay your Parking Tickets here. Excise tax demand bills are due 14 days from the date of issue.

According to MGL Chapter 60A Section 2 Failure to receive notice shall not affect the validity of the excise. Payable in full within thirty days of issue. Date of Birth.

Important information Regarding Your Property Tax Excise Tax Water Sewer Bill Due Date. All fees and penalties are tax laws under MGL. Monies are both collected and deposited.

Download Or Email TA-1 More Fillable Forms Register and Subscribe Now. Excise Tax Personal Property Tax Real Estate Tax and WaterSewer payments also accepted at all. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Notice of Delinquent Property Taxes. Apply for a resident parking permit. Drivers License Number Do not enter vehicle plate numbers spaces or dashes.

Water Sewer Bill. The collector will send a demand which must. The excise rate is 25 per 1000 of your vehicles value.

Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise tax. Get a copy of a marriage certificate. Parking Ticket Payment Link.

The tax is generated by the Registry of Motor Vehicles RMV who then sends out billing information to the city or towns assessor. FRAMINGHAM The City of Framingham motor vehicle excise tax bills are due this month. You pay an excise instead of a personal property tax.

An excise must be paid within 30 days of the issuance of the bill. Ad Access Tax Forms. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Pay your real estate taxes. Any unpaid bill accrues interest at a rate of 12 per annum from the 31st day to the date of payment. Lanesborough Town Hall 83 North Main Street PO.

Clicking the payment of choice will display the available options and any associated service fees. Complete Edit or Print Tax Forms Instantly. If your vehicle isnt registered youll have to pay personal property taxes on it.

Weymouth Tax Rate History. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. Pay a parking ticket.

Pay your motor vehicle excise tax. Pay Excise Tax Demands Online. To avoid not receiving an excise tax bill on time or at all please keep the Registry your local Tax Assessor and the Post Office aware of your current mailing addressFor more information on Motor Vehicle Excise Tax go to.

Learn about excise tax and how Avalara can help you manage it across multiple states. Demand bills will be sent on. Common payments and forms.

Excise Tax Bills Paying Delinquent Bills That Have Been Turned Over To The Deputy Collector. Request a birth certificate. Or county may impose a basic or first half cent sales tax of 05 RCW 8214030 1.

Town of Seekonk PO. Ad Find out what excise tax applies to and how to manage compliance with Avalara. How to pay the fine for a code.

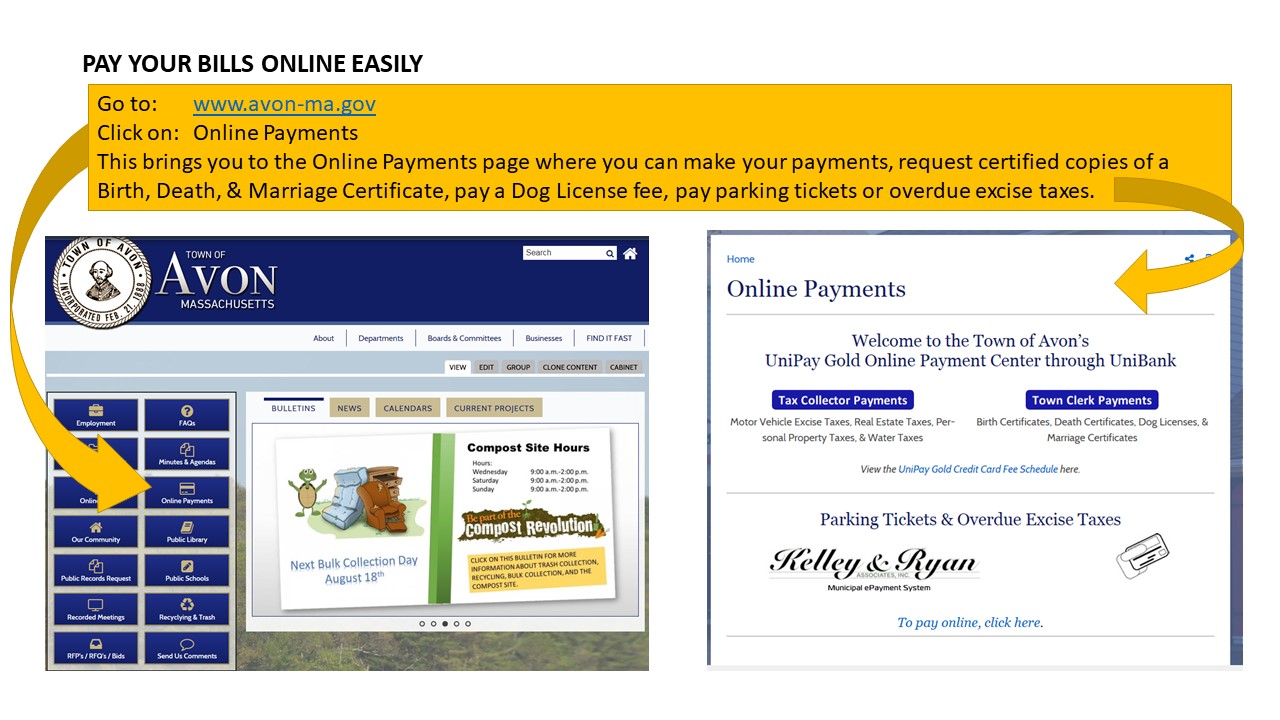

Online Bill Payment Center. To pay your bill on-line click here. Find your bill using your license number and date of birth.

We send you a bill in the mail. The Town of Tewksbury offers residents an easy and secure way to view print and pay their Real Estate Tax Personal Property Tax Vehicle Excise Tax and Water and Sewer bills online. There is a credit.

The excise tax law establishes its own formula for valuation. You may pay these bills at the Tax Collectors Office in the Millis Town Hall with. Excise bills must show the date upon which the bills were issued and must contain the statement Due and Payable in Full Within 30 Days of Issue A payment to be timely must be received in the collectors office on or before the close of.

The following steps for collection are set forth in MGL. Pay excise tax online everett ma.

Tax Bill Information Falmouth Ma

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

Excise Tax In Mass 2019 Pp2 2015 S550 Mustang Forum Gt Ecoboost Gt350 Gt500 Bullitt Mach 1 Mustang6g Com

Pay Your Bills Online Easily Avon Ma

Do You Report Paid Excise Tax In Massachusetts

Motor Vehicle Excise Tax Bills Leicester Ma

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Online Payments Watertown Ma Official Website

Motor Vehicle Excise Marshfield Ma

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

Treasurer Collector Town Of Montague Ma

How To Calculate Cannabis Taxes At Your Dispensary

Massachusetts State Revenue 1 00 Deed Excise Tax D4 Used Repaired Ma Ebay

Did You Know Motor Vehicle Excise Tax